This formula only uses to make assumptions and calculate the quantity of inventory being sold. To calculate the valuation of goods sold, it will be a problem when the cost we spend changes over time. Small business owners generally adopt the periodic inventory system while building their company. You can reassess your needs as your business grows; you may decide to switch to the perpetual method when the benefits outweigh the costs of installing the system. Try Skynova’s accounting software, and you won’t have to spend time learning how to do your own journaling. The double-entry accounting feature records every transaction, ensuring there’s a complete accounting record for your business.

Inventory Cycle Count: A Detailed Guide Including Definition, Methods, Advantages and Processes in 2023

While both the periodic and perpetual inventory systems require a physical count of inventory, periodic inventorying requires more physical counts to be conducted. Knowing the exact costs earlier in an qualifying relative accounting cycle can help a company stay on budget and control costs. Under periodic inventory procedure,the Merchandise Inventory account is updated periodically after a physical count has been made.

Advantages of Periodic Inventory Control System

The ability to have real-time data to make decisions, the constant update to inventory, and the integration to point-of-sale systems, outweigh the cost and time investments needed to maintain the system. However, the need for frequent physical counts of inventory can suspend business operations each time this is done. There are more chances for shrinkage, damaged, or obsolete merchandise because inventory is not constantly monitored. Since there is no constant monitoring, it may be more difficult to make in-the-moment business decisions about inventory needs. The example below has the same activities as above, except the company tracks each unit individually and what it purchased.

Shipping on Inventory Purchases

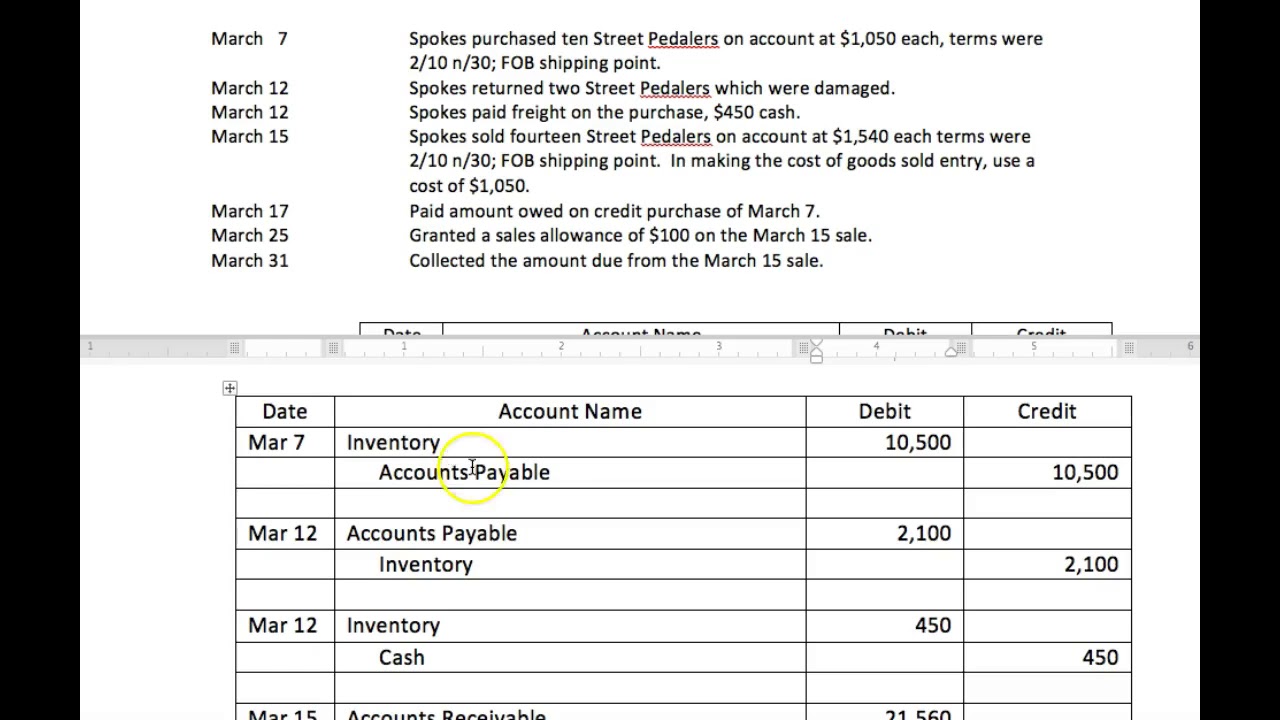

If the difference is positive, the inventory account will be debited for the difference and if it the difference is negative, the journal entry will credit the inventory account by the difference. When the company purchase inventory, they have to record purchase and accounts payable. 1If the net method is applied by Rider Inc. the initial purchase entry is recorded as $245.

Get in Touch With a Financial Advisor

The periodic method does not record the cost of the inventory sold for a particular sale. For the manufacturer, it refers to the raw material, work in progress, and finished products as well. Inventory is the assets that a company will sell to generate revenue for the business.

Explaining Periodic Inventory Control Systems

The periodic inventory journal entry is used to record the adjustment to the inventory records and to update the cost of goods sold. The journal entry is also used to update the balance sheet for the cost of goods that were sold during the period. Furthermore, as the journal entries show, inventory purchases are not debited to the merchandise inventory account. There are two systems that we can use to manage the inventory, periodic and perpetual. The periodic inventory system will record the purchase inventory into the purchase account. It is the temporary account that will be reversed to zero on the reporting date.

The physical counting approach to the inventory management system is through periodic inventory system techniques. It is done regularly to determine inventory data that affect the cost of goods sold. Periodic inventory control is a difficult task that requires time and effort. As a result, small enterprises with little need for inventory typically use the periodic inventory approach.

- At the end of the accounting period, the business conducts a physical count and calculates the ending inventory.

- Then, a second closing entry is to reduce the balance of the COGS account, by the year-end inventory still on hand.

- While both the periodic and perpetual inventory systems require a physical count of inventory, periodic inventorying requires more physical counts to be conducted.

- With this application, customers have payment flexibility, and businesses can make present decisions to positively affect growth.

- Shrinkage is a term used when inventory or other assets disappear without an identifiable reason, such as theft.

At the end of the year, or at the end of any other timing interval businesses choose, a physical inventory count is done, to recognize the amount of remaining inventory. That’s why a periodic inventory system is only mainly used by small businesses with limited inventory and few financial transactions. Once the ending inventory and cost of goods sold are clarified, the accounts require adjustment to reflect the ending inventory balance and the cost of goods sold. Preparing financial statements under the periodic inventory system means calculating the cost of goods sold during the period and the ending inventory.

A periodic system isn’t useful if you need to investigate to identify missing inventory or unbalanced numbers. This issue will arise as your operation grows and becomes more challenging to control positively. The content within this article is meant to be used as general guidelines in the periodic inventory system and may not apply to your specific situation. Always consult with a professional accountant to ensure you’re using methods best suited to your business needs.